Climate change risks and opportunities and financial impacts

Since the Paris Agreement in 2015, responding to climate change has become an issue that both governments and enterprises must actively address. After the 2021 Climate Change Conference (COP26), representatives from various countries proposed the goal of achieving “Net-Zero by 2050.” COP27 in 2022 reaffirmed the importance of limiting global temperature rise to below 1.5°C. At COP28 in 2023, the first global stocktake of the Paris Agreement was conducted, revealing that efforts to curb global warming remained insufficient. The conference once again urged governments and enterprises to accelerate the transition toward net-zero or low emissions and to invest in low-emission technology research and development (R&D) to reduce carbon emissions. In 2024, COP29 focused on key issues such as climate financing, the establishment of a carbon market, and the phased-out use of unabated coal-fired power plants and inefficient fossil fuel subsidies. However, meaningful progress in climate action remained limited, indicating that further efforts are still required from all nations.

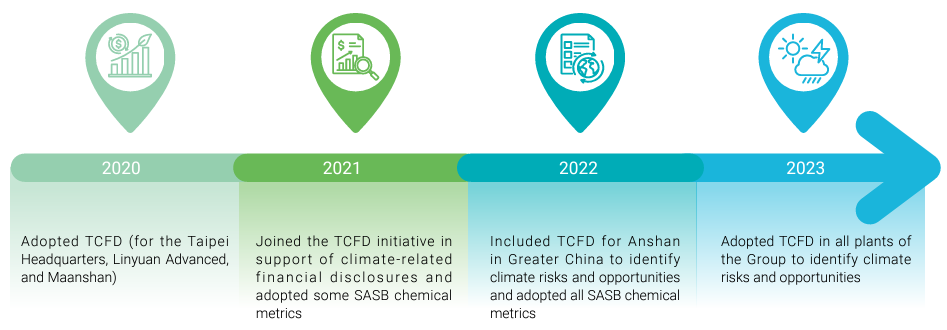

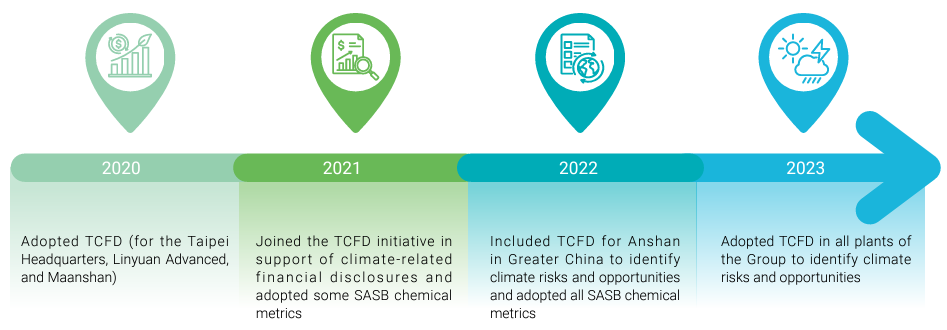

The government of Taiwan also officially announced “Taiwan's Pathway to Net-Zero Emissions in 2050 and Strategy” in 2022, and released the "beta version" of Taiwan’s NDC 3.0 in 2025. The proposed targets aim to reduce net greenhouse gas emissions by 28±2% by 2030 and by 38±2% by 2035, compared to 2005 levels. Given the tightening of domestic and international greenhouse gas regulations, as well as the potential direct impacts of natural disasters caused by extreme weather events on business operations, both transition and physical climate-related risks are expected to affect corporate financial performance. Since 2020, in line with the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD), CSRC has identified climate risks and opportunities through discussions in ad-hoc meetings and set response targets to gradually mitigate these risks. The scope of assessment has been expanded year by year. In 2023, we incorporated all group-wide production sites — including those in Greater China (Taipei Headquarters, Linyuan Advanced, Consolidated Resource, Maanshan, Anshan, and Chongqing), India (CCET and CCIPL), and the United States (Ponca and Sunray) — achieving 100% identification of climate risks and opportunities. We aligned our reporting boundaries with the TCFD framework, adopted all Sustainability Accounting Standards Board (SASB) chemical sector metrics, and signed the TCFD statement of support.

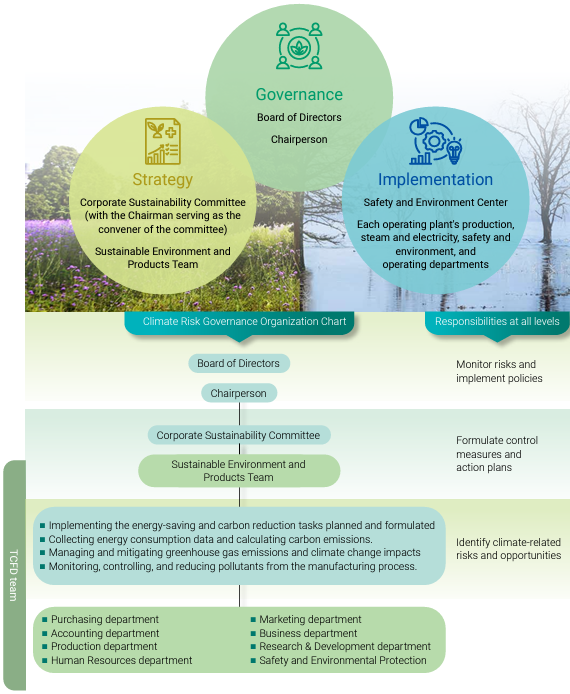

Governance

In climate governance, the Board of Directors serves as the Group’s highest governing body overseeing climate change strategies and initiatives. The Corporate Sustainability Committee has established the “Sustainable Environment and Products Team” and the “Circular Manufacturing Team”, which operate across plants and business units. These teams are responsible for planning and implementing carbon reduction, greenhouse gas emission control, and climate change impact management and mitigation measures. We identify relevant climate change risks and opportunities through each operating plant and department, develop countermeasures, and report the identification results to the Corporate Sustainability Committee on a regular basis. The Corporate Sustainability Committee formulates control measures and action plans for various climate change-related risks and opportunities, adjusts and identifies climate change factors in a timely manner, and assigns each working team to implement control and action plans in accordance with the environmental policies. The Corporate Sustainability Committee regularly reports the core climate risks and opportunities faced by CSRC, countermeasures, and the implementation results to the Board of Directors per year, so that the board can keep abreast of the climate-related risks and opportunities, decide on the relevant management policies, and supervise the implementation.

Note For the complete sustainability governance organizational chart and corresponding responsibilities, please refer to Sustainability blueprint of this report.

Organizational structure of climate risk governance

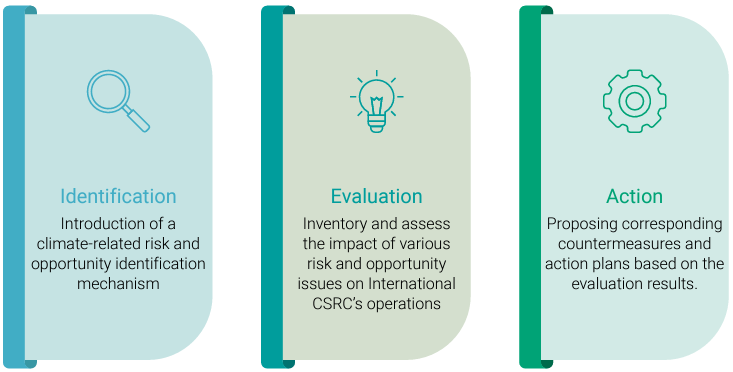

Strategy

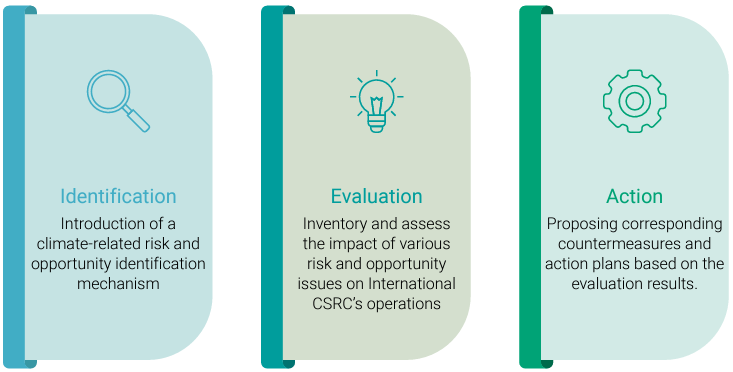

CSRC's strategy for climate-related risks and opportunities includes the three major steps of identification, evaluation, and action. A climate-related risk and opportunity identification mechanism has been adopted to fully examine and evaluate the impact of various risks and opportunities on the operations of CSRC and manage them. In 2024, we adopted the same framework to update the examination and evaluate climate-related risks and opportunities.

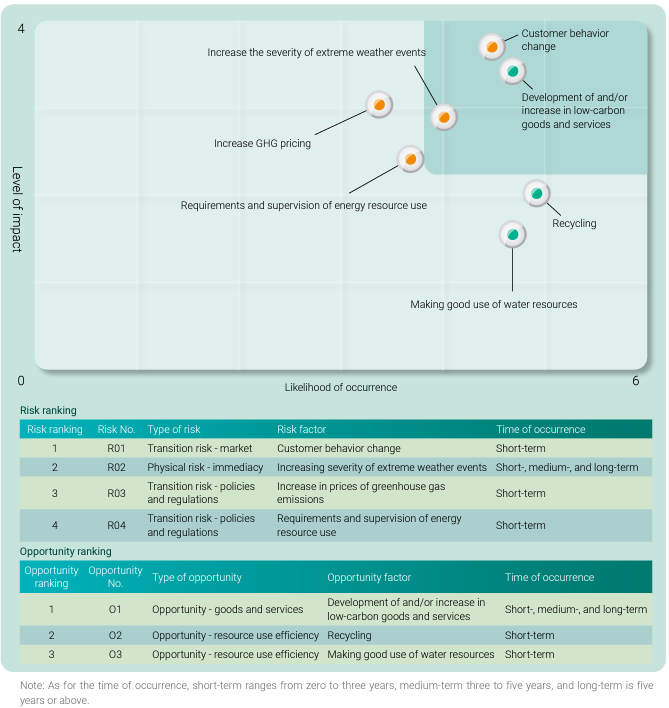

A matrix of climate change-related risks and opportunities is drawn based on the results of the evaluation of the level of impact and likelihood of impact. It is found that the top two potential risks that CSRC should pay attention to include "customer behavior change" in market risks and "increased severity of extreme weather events" in physical risks; the biggest potential opportunity identified is "development of and/or increase in low-carbon goods and services". CSRC proposes corresponding countermeasures based on the climate-related risks and opportunities identified and regularly tracks the implementation results. In addition, we continue to pay attention to international benchmarking companies in the same industry, sustainability trends, and emerging climate-related risks and opportunities, hoping to strengthen CSRC’s operational resilience to climate change and effectively reduce the impact of our operations on the environment.

Matrix of climate change-related risks and opportunities in 2024

Risk Management

In order to understand the impact of climate change on the operations of CSRC, we gradually focus on and manage major risks and opportunities issues through the following identification mechanisms. First, we screened out eight risks and six opportunities related to the chemical industry based on the characteristics of the industry and then handed them over to the manager of each operating plant and various departments to collect domestic and foreign regulations and market/technology issues through literature research and case studies, to fully understand the impacts of various climate risks and opportunities. Then, based on the three aspects of time (short-term, medium-term, or long-term), likelihood of occurrence, and level of impact on operations, we selected significant potential climate risks and opportunities and identified two significant risks and one major opportunity after sorting and ranking through the climate change risk and opportunity matrix. Finally, the senior management reviewed the results to confirm the relevant risks and opportunities and proceeded to take relevant countermeasures.

In order to better understand the impact of climate change on the Company, the two significant risks and one major opportunity identified were qualitatively and quantitatively analyzed through scenario analysis to assess the Company's resilience to climate change risks under different external conditions under physical risk scenarios and transition risk scenarios.

Physical risk scenarios:

We used the RCP8.5 scenario (assuming that all countries in the world do not take any new reduction actions in the future, resulting in an atmospheric radiation reaching 8.5 Wm-2 and a carbon dioxide concentration of over 1,370 ppm, which is the most severe scenario among the four scenarios, representing different greenhouse gas concentrations, proposed by the UN Intergovernmental Panel on Climate Change (IPCC) in the Fifth Assessment Report (AR5) and the climate assumptions in international journals for each region for analysis. The relevant assumptions for 2050 are as follows:

- 14% increase in torrential rain and 50% in smog in Greater China

- 200% increase in smog in India

- 40% decrease in blizzard in the United States

Physical risk considerations:

Increase in the severity of extreme weather events, such as typhoons, floods, (unusual) heavy rains during the plum rainy season, heavy snowfalls, and smog.

Transition risk and climate opportunity considerations:

- Customer behavior change: In response to customers’ requirements, the Group participated in sustainability ratings and obtained sustainability certifications, including EcoVadis rating and ISCC PLUS certification.

-

Development of and/or increase in low-carbon goods and services:

| a. |

Through the R&D of low-carbon technology, we provide the market with new low-carbon solutions and launch low-carbon products to meet customer needs, so as to increase orders received and improve performance. |

| b. |

We use more efficient production and distribution processes, including replacing energy-saving equipment to save electricity, building new waste heat boiler heat exchangers to increase steam generation efficiency, and replacing high-temperature air preheaters (APHs) to reduce fuel consumption. |

| c. |

We use low-emission energy sources, including solar and power generated from steam, sell electricity to external parties; increase self-consumption of electricity through solar power generation and purchase of renewable energy certificates to reduce power purchase costs. |

Transitional risk scenarios:

CSRC has plants in Greater China, India, and the United States, so we have responded to Taiwan's Pathway to Net-Zero Emissions in 2050 and Strategy and the Climate Change Response Act announced by the government of Taiwan and evaluated transition risks using BAU and IEA B2DS scenarios in line with international trends, law and regulations, and stakeholders’ requirements for commitment to net zero by 2050. With that, CSRC will face the following impacts:

| Market risks |

Customer behavior change |

The increase in the awareness of climate change has caused changes in customer preferences for products/services, which may lead to changes in procurement policies. If the products do not meet customer requirements or standard for low-carbon products, product sales and market share may be affected. |

| Impact on the Company |

Countermeasures |

| The financial impact accounts for 72% of the total financial impact within the TCFD scope. |

|

Impacts on the Group's plants:

|

Measures taken by the Group's plants:

- Obtaining EcoVadis certification and formulating improvement plans based on the rating results. (In 2024, the Group achieved a Silver Medal ranking, placing in the top 15%.)

- Preparing documents required for the ISCC PLUS certification (The U.S. plant obtained ISCC PLUS certification in 2024, while the Linyuan Advanced Plant received certification in January 2025. The Maanshan Plant and India's CCET are expected to obtain ISCC PLUS certification within 2025.)

- Preparing for the sustainable product certification system, including product carbon footprint (ISO 14067) and LCA.

- Preparing CDP-related materials and hiring professionals for coaching.

- Conduct a comprehensive inventory of Scope 1 to 3 emissions across all facilities, research the SBTi (Science Based Targets initiative) methodology, and establish decarbonization commitments.

|

| Physical risk |

Increasing severity of extreme weather events |

Extreme climate events (typhoons, floods, (unusual) heavy rains during the plum rainy season, heavy snowfalls, smog, etc.) lead to power outages, water rationing, or equipment damage, resulting in work stoppages and business interruption; interruption of supply of raw materials, resulting in the inability to produce; or inaccessible roads, resulting in goods failing to be delivered as scheduled. |

| Impact on the Company |

Countermeasures |

| The financial impact accounts for 28% of the total financial impact within the TCFD scope. |

|

Greater China:

Linyuan Advanced

- Flooding: The plant was flooded due to a typhoon. The flooding caused by wind disasters over the past five years is relatively minor, and only the roads inside the plant are flooded, obstructing the travel of personnel.

Maanshan

- Flooding: As it is only 1 kilometer away from the Yangtze River in China and it is located in low-lying areas, the plant was flooded to about 50cm in 2020 due to torrential rain and the failure to open the main drainage valve of the local government in time. The plant was forced to shut down the production line for one day.

- Smog: In 2019, during heavy pollution weather, enterprises below Grade A were required to stop operations. In 2022, Maanshan successfully upgraded from Grade C to Grade B.

- Blizzard: In 2023, a heavy snowfall only hindered commuting but did not affect the normal production of the production lines and the supply of raw materials and the delivery of products.

Anshan

- Smog: Production was suspended between 2021 and 2022 due to heavy pollution weather.

India:

CCIPL

- Smog: Production was suspended at the end of 2018 due to severe air pollution.

USA:

CCC Ponca and CCC Sunray

- Blizzard: There were two severe power outages in 2023 and 2024 due to winter storms, causing half a month of work stoppages and significantly affecting profitability.

|

Greater China:

Linyuan Advanced

- Flooding: It desilts regularly and confirms supplies and disaster prevention measures before wind disasters. It closes iron gates and water-controlling gates in the plant and prepares sandbags to prevent flooding in the event of heavy rains.

Maanshan

- Flooding: It ensures smooth drainage and has emergency supplies in place, such as flood-controlling sandbags. It cooperates with government policies and regularly holds emergency response exercises during flood-prone periods.

- Smog: It adds environmental equipment to reduce emissions, implements 6S management on-site, reduces leakage from equipment pipelines, strengthens equipment maintenance, and reduces fugitive emissions. It strives to improve the national emission level.

- Blizzard: It has added snow removal tools, regularly checks the load-bearing capacity of building roofs, and holds emergency exercises.

Anshan

- Smog: It adds environmental equipment to reduce emissions, implements 6S management on-site, reduces leakage from equipment pipelines, strengthens equipment maintenance, and reduces fugitive emissions. It strives to improve the national emission level.

- Blizzard: It has added snow removal tools and regularly checks the load-bearing capacity of building roofs.

India:

CCIPL

- Smog: It has installed halogen lamps to control visibility. During heavy smog, shipments are affected and buffer time is needed.

- It has formulated and implemented a comprehensive Emergency Response Plan (ERP) to quickly and effectively mitigate the impact of extreme weather events.

USA:

CCC Ponca and CCC Sunray

-

Blizzard: It confirms that the blizzard contingency procedures are up-to-date, repairs and protects the affected equipment during the most recent blizzard, and confirms the equipment required for a blizzard.

|

| Policy and regulation risk |

Increase in carbon pricing |

Operational sites are required to reduce carbon emissions due to the total quantity control mandates from various governments in order to achieve net-zero targets, such as the European Union, the United States, India, mainland China and Taiwan. If a company is a major carbon emitter, the organization may be required to increase carbon offsets, or pay higher carbon fees, or need to purchase carbon credits through carbon trade to offset emissions. The price per ton of carbon emissions may increase year by year, putting pressure of higher capital expenditure on organizations. |

| Impact on the Company |

Countermeasures |

|

Greater China:

Linyuan Advanced

- The main source of carbon emissions is Scope 1 (feedstock oils). Due to the decrease in the carbon number of feedstock oil in recent years, it is necessary to use more feedstock oil to produce the same amount of carbon black, indirectly leading to an increase in greenhouse gas emissions and an increase in operating costs (increase in the purchase of feedstock oil and carbon fees paid). Based on Taiwan's Climate Change Response Act, the cost of carbon fees will increase.

Maanshan

- At present, the Chinese government has not yet imposed total quantity control on the Maanshan Plant.

Anshan

- In 2021, Anshan was listed as a key emitting enterprise in the chemical industry by the local government of China. However, the government has not yet imposed total quantity control on the amount and intensity of emissions.

Chongqing

- Chongqing plant is included in Chongqing’s list of key greenhouse gas emitters in 2021 and 2022. In March 2024, in accordance with the Notice from Chongqing Municipal Ecology and Environment Bureau on the Requirements for the Chongqing Carbon Market’s Carbon Allowance and Settlement of 2021 and 2022 Carbon Emissions, Chongqing purchased carbon allowance to fill the gap and fulfill the contract at a cost of RMB 310 thousands.

India:

CCET and CCIPL

- The Indian government is currently evaluating a carbon emission tax system and has only provided a draft policy framework, but has not yet finalized the implementation timeline, so there is no impact at present. (CCIPL is an enterprise included in the consideration by the Indian government.)

USA:

CCC Ponca and CCC Sunray

- CCC Ponca and CCC Sunray's emissions and industry are in line with the requirements of the U.S. Clean Competition Act (CCA), but the implementation timeline is not yet clear.

|

Greater China:

Linyuan Advanced

- It regularly reviews greenhouse gas emissions and appoints a third party to verify its greenhouse gas inventory.

- It is actively seeking low-carbon alternative raw materials, enhancing equipment processing efficiency, and optimizing production processes to reduce carbon emissions.

Maanshan and Anshan

- They appoint a third party to verify greenhouse gas inventories per year and continue to calculate carbon emissions independently (monthly) to control carbon emissions by reducing the use of materials.

- They have established an e-carbon management system and formulated carbon reduction plans and targets at the beginning of each year.

Chongqing

- It appoints a third party verify greenhouse gas inventories per year.

- It works to increase the furnace temperature to reduce fuel consumption per unit of production and reduce the consumption of feedstock oil.

- In 2022, the burner of Line U1 was equipped with a flue gas recirculation system, and the existing burner was replaced with a low-nitrogen one, and the carbon black tail gas was used to replace natural gas to reduce the natural gas used in the waste gas furnace.

India:

CCIPL

- It engages in regular research, monitoring, and analysis on climate change and changes in emission policies around the world and in regions and has formulated a comprehensive carbon management strategy in line with global best practices and regulatory requirements.

- It analyzes product carbon footprint, including tracking and reporting emissions and setting emission reduction targets.

- It offers training to employees on climate risk awareness, mitigation strategies, and sustainability practices.

CCET

- Investing in waste heat recovery power generation, which operates without external power input, helps reduce carbon emissions.

- It has replaced reactors and heat exchangers and purchased backup heat exchangers to reduce carbon emissions.

USA:

CCC Ponca and CCC Sunray

- They improve process efficiency, reuse tail gas, and invest in cogeneration equipment to produce and sell electricity and steam.

|

| Policy and regulation risk |

Requirements and supervision of energy resource use |

- Due to the impact of the national water-saving policy, heavy water users will be subject to water conservation charges, which will increase operating costs.

- In addition to water-saving policies, other energy resources-related laws and regulations, such as electricity (big electricity users), oil, or natural gas, may also increase operating costs.

|

| Impact on the Company |

Countermeasures |

|

Greater China:

Linyuan Advanced

- Taiwan Water Consumption Fee: NT$3 per cubic meter for water consumption exceeding 9,000 cubic meters. Charging period: From November of the prior year through April of the year, and the charge is made once per year.

Maanshan

- As per Maanshan Urban Fixed Public Water Use Management Regulations of China: The first stage is water consumption within the quota, which is determined according to the tap water sales price in a corresponding category announced by the competent authority (hereinafter referred to as the "base water price"); the second stage is for water use that is 20% or less than the amount, and additional water fee is charged at 0.5 times the base water price; the third stage is for water use exceeding the amount by more than 20%, with an additional water fee charged at one time the base water price.

Anshan

- As per the Water Law of the People's Republic of China implemented in Liaoning Province, the water allocation program of the administrative area is formulated by the local water administrative authority and implemented after being reported to the local government at the same level for approval. The fixed amount of water intake for carbon black is ≤ 24.5 m3/t.

|

Greater China:

Linyuan Advanced

- Linyuan Advanced aims to increase the use of reclaimed water to reduce the impact of the Water Consumption Fee.

- It aims to maintain the stable operation of the wastewater plant to produce reclaimed water and increase the wastewater recycling rate.

Maanshan

- Applied for a water use quota: the permitted water usage for 2024 was 834,257.4 m3, while the actual usage was 662,943 m3, demonstrating water-saving efficiency in compliance with national requirements.

- It works to increase the wastewater recycling rate and reduce wastewater discharge.

Anshan

- It works to increase the wastewater recycling rate and reduce wastewater discharge.

Chongqing

- There is a wastewater treatment plant on-site, and no wastewater is discharged, and the wastewater recycling rate is 100%.

|

| Opportunities from Goods and service |

Development of and/or increase in low-carbon goods and services |

- Through the R&D of low-carbon technology, we provide the market with new low-carbon solutions and launch low-carbon products to meet customer needs, so as to increase orders received and improve performance.

- We use more efficient production and distribution processes, including replacing energy-saving equipment to save electricity, building new waste heat boiler heat exchangers to increase steam generation efficiency, and replacing high-temperature APHs to reduce fuel consumption.

- We use low-emission energy sources, including solar and power generated from steam, sell electricity to external parties; increase self-consumption of electricity through solar power generation and purchase of renewable energy to reduce power purchase costs.

|

| Description of impact on the Company |

Countermeasures |

| The potential financial impact is projected to increase by approximately 5% in 2025 and around 17% in 2030 under the Business-As-Usual (BAU) scenario. |

|

Impacts on the Group's plants:

- Based on the technical test of the alternative oils (tire pyrolysis oil, TPO), the oils can reduce carbon emissions and improve resource utilization rate.

- Recycled carbon black (rCB) mixed with carbon black can reduce product carbon emissions and improve resource utilization rate without affecting product performance.

- Replacing APHs can effectively increase the temperature of the reactor and make carbon black burn more completely, which in turn helps to reduce oil consumption per unit of production and increase carbon black output with the same oil input.

Greater China:

Linyuan Advanced

- Due to the increasing attention paid to energy efficiency in the electric vehicle and the automobile industries, it has developed low-rolling resistance carbon black series, CC series, and T series, to increase market share.

|

Greater China:

Linyuan Advanced

- The introduction levels of TPO and rCB are adjusted based on process parameters to ensure the stable carbon black quality.

- APH units are regularly cleaned to maintain heat exchange efficiency and are replaced as needed; aging pipelines are also phased out accordingly.

- New waste heat boiler heat exchangers were installed to increase steam generation efficiency.

- Solar power is generated for self-consumption and bulk sale; tail gas at the end of the process is recycled and converted into steam for neighboring factories or its own operation.

Maanshan

- The introduction levels of TPO are adjusted based on process parameters to ensure the stable carbon black quality.

Maanshan, Anshan, and Chongqing

- Modifying the APH specifications can increase the furnace temperature and reduce the fuel consumption per unit of carbon black production.

- Low-nitrogen burners were installed to reduce natural gas consumption and carbon emissions.

- Power equipment was replaced with energy-saving motors to reduce electricity consumption.

- New waste heat boiler heat exchangers were installed, and the steam generation efficiency increased.

- The waste heat is used for heat exchange to produce steam, and the steam will be used for steam power generation; the electricity generated will be transported to the national grid for sale of electricity.

India:

CCET

- Natural gas, rather than oil fuel, has been used as the fuel to start boiler burners. The price of natural gas in India are high due to government control. If the prices are reduced in the future, it will be able to be used to produce carbon black to offset the carbon tax.

CCET and CCIPL

- The waste heat is used for heat exchange to produce steam, which is then utilized for steam power generation; the electricity generated is sold to other factories.

USA:

CCC Ponca and CCC Sunray

- The Ponca plant utilizes waste heat recovery for self-generated power.

- Ongoing discussions to implement carbon capture and storage (CCUS) technology to reduce carbon emissions, which is expected to achieve carbon reduction and create new business opportunities.

- They purchase renewable energy.

|

| Opportunities from resource use efficiency |

Recycling |

Through material recycling (such as waste heat recovery and reuse, pallets, waste recycling), it is possible to extend the life cycle and reduce operating costs. |

| Description of impact on the Company |

Countermeasures |

|

Impacts on the Group's plants:

- Recovered process tail gas is sent to cogeneration units for power generation or to produce steam for external sale, thereby increasing revenue.

Greater China:

Linyuan Advanced

- Waste is recycled and reused, such as waste bulk bag, waste bricks, and remade into SRF.

- Waste heat is recycled and reused.

Maanshan, Anshan, and Chongqing

- Pallets (made of plastic and reused by two or three customers) are shared.

- Ground carbon are sold.

- Flue gas desulfurization waste - desulfurization gypsum is transported to partner cement manufacturers to be used as a raw material in cement production.

- Waste heat is recycled and reused.

India:

CCET and CCIPL

- Plastic pallets are reused.

- Flue gas desulfurization waste is processed into gypsum and sold to local cement manufacturers.

- High-efficiency waste heat recovery equipment was installed.

|

Greater China:

Linyuan Advanced

- The efficiency of waste heat recovery and reuse is monitored.

- Waste disposal documents are sorted according to the storage location, regularly audited by the EHS Department, and passed ISO 14001 certification every year.

- It actively seeks waste recycling companies.

Maanshan, Anshan, and Chongqing

- The efficiency of waste heat recovery and reuse is monitored.

- They continue to use the pallet rental service. Pallet rental companies are responsible for recycling as many pallets as possible, and each supplier does not need to purchase additional pallets.

- In 2024, a total of 1,528.96 tons of desulfurized gypsum was transported to partner cement plants for use as raw material in cement production.

India:

CCET

- In 2024, a total of 1,078.47 tons of desulfurized gypsum was transported to partner cement plants for use as raw material in cement production.

|

| Opportunities from resource use efficiency |

Making good use of water resources |

- Recycled water, rainwater, and wastewater in the plants for reuse can reduce the use of water resources and reduce operating costs.

- The leakage of water in the production process is reduced, such as water consumption, thus reducing operating costs.

|

| Description of impact on the Company |

Countermeasures |

|

Impact on the Group's plants:

- Recycling of process and wastewater in each operating plant helps to reduce raw water intake, thereby reducing water costs.

Greater China:

Linyuan Advanced

- Linyuan Advanced stopped the operation of part of its production lines due to drought and water shortage. Recycling process wastewater can effectively reduce water consumption.

- Recycling water can reduce the problem of excessive water costs caused by Water Consumption Fee and reduce water costs.

India:

CCET

- A wastewater recycling system was installed.

- Recycling steam condensate from nearby customers who buy our steam could help reduce the use of fresh water.

|

Greater China:

Linyuan Advanced

- At present, we continue to repurchase the steam condensate from LCY Chemical Corp. back to our plant.

- The operation of the wastewater treatment plant has remained stable.

- Steam generated during operations is sold to neighboring factories, increasing revenue, while neighboring factories will return remaining steam condensate to the Linyuan Advanced Plant for these neighboring factories.

- Through this water balance project, the reclaimed water from the cooling water tower is returned to the desulfurization tower, the effluent of the air dryer in the steam and power zone is recycled, the wastewater from the rainwater tank is recycled, and the backwash water regenerated from the purified water equipment is recycled.

Maanshan

- The desulfurization wastewater is treated and filtered before being reused in the process.

- The process wastewater is recycled and purified in the in-house sewage treatment plant. After purification, at least 95% of the wastewater is recycled and used in the manufacturing process, and the rest is used for floor cleaning and other purposes, replacing tap water.

- Maanshan has formulated the Wastewater Treatment Plant Operating Regulations with reference to "IATF 16949-2016 Automotive Industry Quality Management System", "ISO 9001-2015 Quality Management System" and "GB/T 19022-2003 Measurement Management System Measurement Process and Measurement Equipment Requirements", to regulate the operation of sewage treatment equipment, abnormal accident handling procedures, and occupational safety requirements to ensure that the sewage treatment plant can efficiently manage and achieve the purpose of water purification.

India:

CCET

- Developed a plan and worked closely with steam buyers to recover steam condensate from the steam sold to customers.

- A wastewater treatment and recycling system has been installed, and the construction of on-site rainwater harvesting facilities is under consideration and will be implemented in the next 3-5 years.

USA:

CCC

- They recycle all water around the plants and reuse all water resources.

|

Indicators and targets

As Taiwan's Pathway to Net-Zero Emissions in 2050 and Strategy and the Sustainable Development Roadmap for TWSE/TPEx Listed Companies released by the Financial Supervisory Commission (FSC), key indicators are used to measure and manage climate-related risks (including physical and transition risks) and opportunities, including greenhouse gas emissions, energy use, customer behavior change (circular economy), and the development and/or increase of lowcarbon goods and services. Annual targets are set for each indicator for management and performance tracking. For the details of the targets sets (short-, medium-, and long-term targets) of each key indicator and the implementation performance in 2024, please refer to the corresponding chapters in the sustainability report.

| Indicator |

Item |

Sustainability report chapter |

| Greenhouse gas emissions |

- Conducting ISO 14064-1 greenhouse gas inventory and verification

- Renewable energy generation

|

Chapter 4.2 Energy and Greenhouse Gas Management |

| Energy use |

- Enhancing energy efficiency

- Recycling process tail gas for self-generation of electricity

- Adopting high-efficiency equipment

|

Chapter 4.2 Energy and Greenhouse Gas Management |

Customer behavior change

(Circular economy) |

- Increasing the number and revenue of green product lines

- Establishing a green supply chain

|

Chapter 3.2 Practicing New Circular Economy Model

Chapter 2.2 Green Products

|

| Development of and/ or increase in low-carbon goods and services |

- Researching and developing low-carbon technology to launch new low-carbon solutions on the market, such as low-rolling resistance carbon black series, CC series and T series.

|

Chapter 2.2 Green Products |