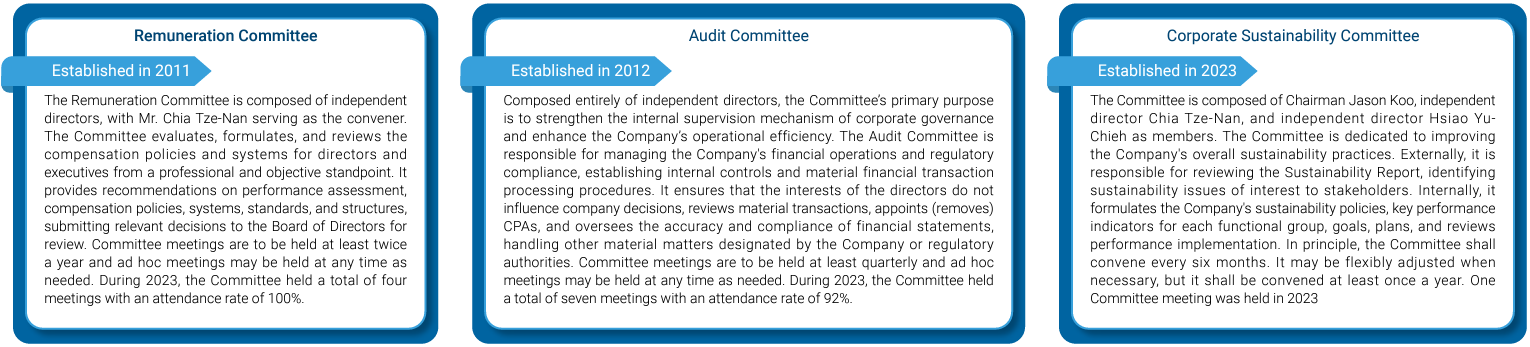

CSRC’s corporate governance organization structure is represented by the Board of Directors as the Company’s business executive authority. We also establish an Audit Committee to perform supervision and establish a Remuneration Committee that is responsible for formulating, reviewing, and evaluating directors, managers and other salary and remuneration related policies. At the same time, the Audit Committee and the Remuneration Committee have also formulated the organizational rules for compliance for these two respective Committees. Furthermore, to thoroughly implement corporate sustainability actions, in 2018 CSRC established the Measures for the Establishment of the Corporate Sustainability Committee. In December 2023, the Board of Directors resolved to elevate the Corporate Sustainability Committee to the level of a functional committee, thereby actively promoting the implementation of corporate sustainability, ethical corporate management, and social responsibility.

Composition of the Board of Directors

According to CSRC's Articles of Incorporation, the number of directors ranges from 7 to 11, with a term of 3 years. Chairman Jason Koo also serves as the Group CEO. CSRC Group comprises 25 companies, including 24 subsidiaries. As a holding company, unlike typical listed companies, each subsidiary has its own characteristics in terms of operating projects. The Chairman reports to the Board of Directors and is responsible for business management, major decisions, and promoting corporate sustainability. The Group CEO manages all affairs of the related companies, executes board resolutions, and supervises the managers of the Company and its affiliates, differing from the role of the President of the Company and therefore avoiding any conflict of interest.

CSRC has seven directors in accordance with the provisions of Article 192-1 of the Company Act. The director election method adopts the candidate nomination system, and directors are appointed by the shareholders’ meeting from the list of director candidates, allowing for consecutive re-election of directors. In 2023, CSRC had eight directors, all of whom were male. Four of them were independent directors,Note accounting for 50%, exceeding one-third and complying with statutory requirements. Among them, five were over 51 years old (62.5%), and three were aged 41-50 years old (37.5%). Directors with employee status accounted for 12.5%.

The 18th Board of Directors of the Company emphasizes diversity, comprising elites from industry and academia. Their industrial experience covers finance, business, finance, investment and mergers and acquisitions, risk management, operations management and other capabilities. They possess expertise in management, international markets, risk management, accounting and financial analysis, law, and ESG and other professional capabilities. Distinguished directors include Jason Koo, Lin Nan-Chou, Chang Chi-Wen, Chang Liang, and Ting Yuan-Wei, who have extensive industrial knowledge; directors Yeh KuoHung and Chia Tze-Nan, who have financial accounting experience; and director Hsiao Yu-Chieh, who has legal experience. The Company continues to arrange various advanced training courses for board members to enhance their decision-making quality and supervisory capabilities, and thus strengthen the functions of the Board of Directors. Furthermore, CSRC is committed to promoting diversity and inclusion within it Board of Directors, firmly believing that female directors can bring unique perspectives and expertise to the board, thereb enhancing the comprehensiveness and innovativeness of decision-making. On March 19, 2024, the Board of Director underwent a comprehensive re-election, increasing the number of directors from 8 to 9, including the nomination of on female director, who was elected at the 2024 General Meeting of Shareholders on May 28, 2024.

Board operation

In 2023, CSRC convened a total of eight board meetings,Note with an average director attendance rate of 97%, complying with the requirement that meetings of the Board of Directors should be held at least once every quarter. Important proposals are disclosed in the shareholder meeting annual report or on the company's website, ensuring transparent and accurate information disclosure. Directors listen to management team reports during Board meetings, and offer guidance and advice while maintaining good communication with the management team. Together, they work to create maximum benefits for shareholders. The remuneration of directors is determined based on their participation in the Company's operations, their contribution value, and the evaluation of compensation levels in the domestic and international industry. The operation of the Board of Directors is based on the indicators of the Corporate Governance Evaluation System. At the same time, it complies with corporate governance standards. As of the end of 2023, all independent directors comply with the regulations concerning independent directors set by the Securities and Futures Bureau of the Financial Supervisory Commission, and there are no circumstances as specified in Article 26-3, Paragraphs 3 and 4 of the Securities and Exchange Act between any directors and independent directors. The Board of Directors of the Company maintains its independence.

Avoidance of conflicts of interest

The powers of the Board of Directors include business planning, profit distribution, capital increase and decrease, important rules and contract approval, appointment and removal of the President, branch establishment and abolition, budget and final accounts review, real estate trading, investments and other business review, and other important matters. The operation of the Board of Directors does abide by the rules of the Board of Directors and relevant laws and regulations. It supervises and understands Company operations and various existing or potential risks for the Company. It maintains good and timely interaction with management to fully leverage the functions of the Board of Directors.

In respect to meeting matters, if a director or the juristic person represented thereby has a stake in a proposal at the meeting, that director shall state the important aspects of the stake in the meeting, and where there is a likelihood that the interests of the Company would be harmed, shall recuse themselves from any discussion and voting, and may not exercise voting rights as proxy on behalf of another director. For more details on directors' recusal from conflicted-interest matters, please refer to page 33 of the 2023 Annual Report of the shareholders’ meeting.

Management Remuneration Policy

The remuneration policy for the President and managers is presented to the Remuneration Committee with reasonable recommendations based on the Company's operational performance, profitability, personal performance and salary market standards etc., before the Board’s approval.

Compensation includes quarterly and year-end bonus. Evaluations cover financial performance, including corporate governance, social care and environmental sustainability. By linking compensation with long-term operations, the goal of sustainable management can be achieved.

| For more corporate governance practices of CSRC, please refer to: | ||

Official website

|

Implementation of Board diversity policy of CSRC

|

Procedures for election of directors of CSRC

|

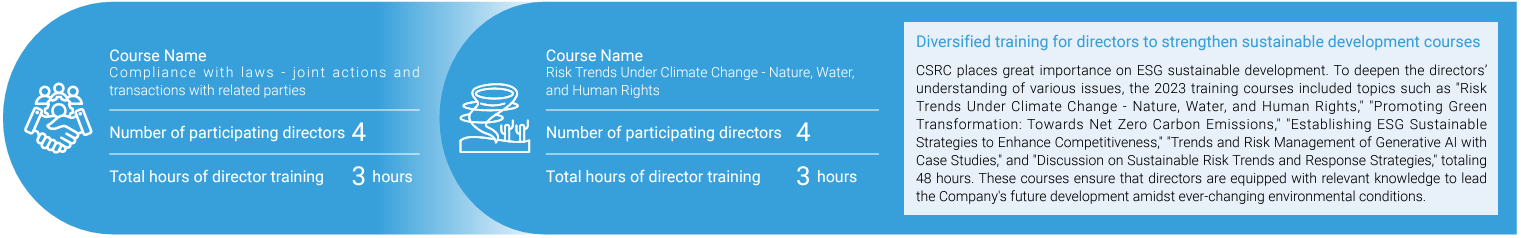

Board of Directors Training

CSRC continually arranges a variety of training courses for board members, periodically providing information on external courses. In 2023, the Company offered two courses, "Compliance - Joint Conduct and Related Party Transactions" and "Risk Trends Under Climate Change - Nature, Water, and Human Rights," inviting instructors to the Company to train directors and managers. This effort aims to continually enhance the diverse expertise of the directors, strengthen their supervisory capabilities, and thereby enhance the board’s functionality and collective intelligence in sustainable development.

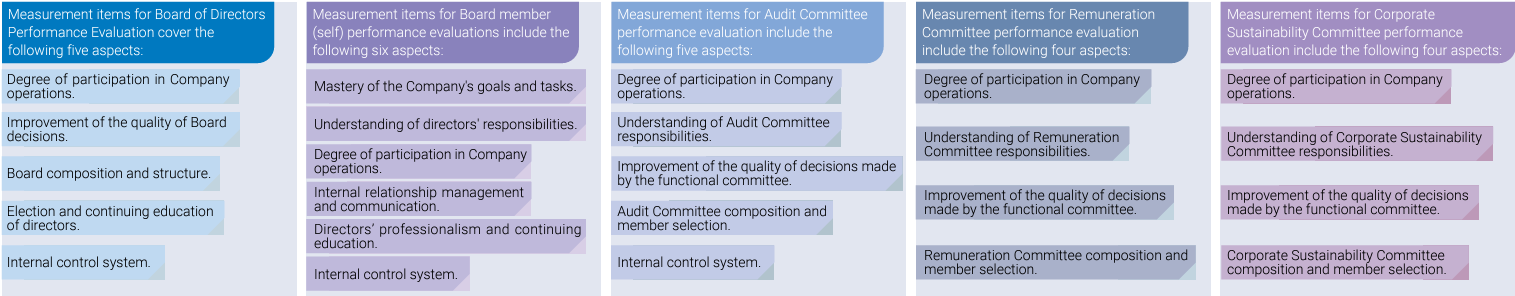

Board of Directors Performance Evaluation

To implement corporate governance and enhance the functionality of the Board of Directors, the Company has established the Board of Directors Performance Evaluation Measures, conducting evaluations annually. The scope of the board performance evaluation includes the entire Board of Directors and individual director members. In addition to the internal self-assessment conducted annually in accordance with laws and the Company's Board of Directors Performance Evaluation Measures, the external evaluation, which was previously conducted every three years, will be conducted annually starting in 2023, with external experts being hired to conduct the performance evaluation. The results of the internal and external performance evaluations of the Board of Directors shall be completed before the end of the first quarter of the following year. Please refer to the Board of Directors Performance Evaluation Report for 2023 for internal and external Note performance evaluation results.

In addition, the Company and its subsidiaries have purchased “Directors and Officers Liability Insurance” for directors, supervisors, and key executives to cover their indemnity obligations during their terms of office. The insurance policy contents are reviewed annually to reduce the risks borne by directors, supervisors, key executives, and the Company, and to establish and enhance the corporate governance mechanism.

Note An external independent professional institution evaluated the operations and performance of the Board for the year 2023 (from January 1, 2023 to December 31, 2023) and issued a report on January 31, 2024, submitted to the Board of Directors on February 26, 2024.

Composition of the Internal Audit Unit

CSRC’s internal audit is an independent unit directly under the Board of Directors. In addition to reporting to the Board of Directors, it reports to the Chairperson and to the Audit Committee quarterly or when necessary. The auditors are all full-time personnel, including one audit supervisor and one auditor. All are qualified as a Certified Internal Auditor. Appointment and removal of internal auditors is done according to relevant laws and regulations and approved by the Audit Committee and submitted for resolution of the Board of Directors.

The evaluation and salary remuneration of internal auditors are regularly evaluated in accordance with the Measures for Appointment, Removal, Evaluation, and Salary and Remuneration of Internal Auditors, the Performance Management Measures, and the Salary Measures approved by the Company's Board of Directors on May 11, 2021. The Audit Supervisor shall sign and report to the Chairman of the Board for approval.

Main duties of the Internal Audit Unit

After the audit has undergone risk assessment, the priority of the audit targets and audit items is determined according to the level of risk, and the annual audit plan is formulated. After approval by the Board of Directors and the Audit Committee, then according to the provisions of the Securities and Futures Bureau of the Financial Supervisory Commission, it shall be submitted for inspection by the Securities and Futures Bureau through the Internet information system before the end of December each year. The audit team shall implement internal audit operations according to the annual audit plan, compose internal audit proposals, and submit audit reports. After the audit report is approved by the Chairman, the units being audited will be notified to improve within a set period of time. Improvement of abnormal matters specified in the internal audit shall be tracked and an internal audit tracking report will be prepared according to the improvement measures developed by the units being audited. After its approval by the Chairman, an "Annual Internal Audit Abnormality Improvement Report" will be prepared and disclosed in the Market Observation Post System before end of May every year and reported to the Securities and Futures Bureau for future reference. For a summary of the relevant audit and tracking reports of 2023, please refer to the explanation under 1.5.2 Risk Identification and Early Warning Process.

The Audit Office is responsible for handling matters concerning the self-assessment of the Company’s internal control system, reviewing the self-assessment report of the internal control system of each unit and subsidiary of the Company and assisting and supervising the implementation of the internal control system of each subsidiary.

The audit supervisor attends the entire Board of Directors and audit committee every quarter. They carry out the business report of the audit office, explaining the audit findings of each inspected unit and the follow-up improvement status. During meetings of the Audit Committee and the Board of Directors, independent directors may provide comments on the content of the audit report, and it will be explained by the audit supervisor. For the approval of the annual audit plan, when the audit office drafts the annual audit plan it will also check the audit key points after the risk assessment. It will list the items to be audited each month in detail, and make detailed explanation to the Audit Committee and the Board of Directors, and it shall be approved by the Audit Committee and the Board of Directors. It is expected that the internal audit operations will meet the needs of corporate governance. In addition to meetings for communication, audit supervisors, accountants and independent directors also directly contact and communicate with each other as needed at any time, maintaining a good interactive relationship.

In the Corporate Social Responsibility Best Practice Principles, CSRC clearly stipulates that when performing corporate social responsibilities, it should respect social ethics and pay attention to the rights and interests of other stakeholders. While pursuing sustainable operation and profitability, it also attaches importance to environmental, social and corporate governance factors and incorporates them into the Company’s management and operation policies. In terms of shareholders’ equity, it sets up a dedicated person in charge of investor relations, The spokesperson and investor relations officer accept shareholder suggestions and concerns and handle disputes. Relevant departments will accept suggestions and handle disputes according to the type of problem.

Creating the highest interests for shareholders is the goal of CSRC and all colleagues. In order to maintain good communication channels with investors and disclose information to shareholders, the Company’s operations and financial conditions are reported to investors in addition to the regularlyconvened annual shareholder meetings, corporate investor meetings, and interim institutional investor meetings. We have established an “Investor Area” on the Company’s official website, and use financial information, corporate governance, and shareholder columns to publish relevant financial statements, corporate investor meeting data and information, internal audits, Company regulations, dividend distributions over the years, important information announcements, and so on. We publish the information in the fastest way to provide it to investors for reference.